New Biden Tax Plan:

✔ Top Federal Tax bracket UP to 39.6%. And this IS NOT just on millionaires and billionaires - this is on any family making over $628K a year. Now, I get it, this is a big number. Anyone making over $600K a year is likely working hard, lucky, and has benefited greatly from being born in, working in, and/or growing a business in America. BUT ...

✔ Do you SEE how this works yet??? First- vilify the "billionaires" who "don't pay their taxes" (even thought that's a lie - rich people pay lots of taxes). THEN - vilify the "millionaires" who "don't pay their taxes" (even thought this is also a lie). THEN - start redefining "millionaires!" Now a millionaire is someone who makes income over $628K. Or someone who has an investment portfolio worth more than $1m. Or someone who has equity in a house + income + investments totaling over $1m. This redefinition of terms is concerning.

✔ Next, I believe they will 100% drop this top income bracket to people making over $500K. Then $250K. Then $100K. Eventually the talking points will be - "anyone who is rich and making over $100K... they just need to pay their fair share, and everything will be fine!" EXCEPT for - it won't be "fine" - because the answers for Democrats is always to simply tax MORE. And the answers for democrats AND Republicans are always to just SPEND MORE. when does it STOP!!!

✔ Couple that with top tax rates of over 10% in several states (California, New York, et. al.) and you start to have a society that REPOSSESSES 50% of EARNED income from those people in society (who presumably) are adding the most value and generating the most GDP.

✔ EXPANSION of the the 32% and 37% tax brackets - capturing more income from lower wage earners.

✔ INCREASE to the capitol gains tax from 15% or 20% (currently) to 25%. KEEP IN MIND - most capital gains are GAINS on investments - that were BOUGHT with EARNED MONEY - that YOU ALREADY PAID TAXES ON. So, you pay taxes when you earn the money - THEN, if you invest the money - AND win... you pay 25% on this investment income.

✔ ALSO keep in mind. If you invest in a stock - and you realize a $10,000 GAIN (aka you invested wisely. Let's say you "bought" $10,000 of stock - and it grew to $20,000 - so you have a $10,000 gain) - you now pay $2,500 in taxes on your gain (EVEN THOUGH you bought the original investment with money you ALREADY paid taxes). AND, if you LOSE - AKA you invested poorly... well, you get to write off $3,000 a year (TOTAL!!!). Is it any wonder WHY people try to cheat the system and game the investment markets? There is an UNLIMITED upside for the government in taxing you when you invest wisely. There is a $3,000 token tax write-off if you LOSE your investment and invest poorly!!!

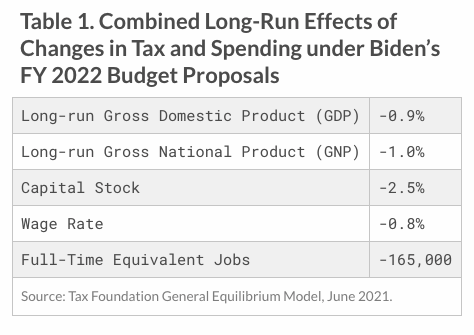

✔ Even the NON Partisan - TaxFoundation . org - estimates that this new tax plan will drop GDP by about 1%. Decrease investments in capital stocks by 2.5%. DECREASE real wages by roughly 1%, and eliminate about 165K jobs from the market place.

... But wait, act now and there's more...

✔ The current proposal is an increase to the Corporate tax rate from 21% to 28%. Let's assume for a second that our tax code was not a total, convoluted, cluster-fuck of a mess. Let's assume corporations actually paid this tax rate of 21% - which they don't. But let's just pretend. So now, you increase this 21% tax rate to 28%. Do you really think Walmart, Costco, Amazon, Target, GM, Ford, et. al. - will just say "ah shucks, I guess we make 7% less money going forward" -OR- do you think they will just raise prices on consumer goods by 7%???? I'll give you two guesses, the first one doesn't count - OF COURSE they are just going to raise costs.

✔ THIS all leads to inflation. Higher personal taxes, higher corporate taxes, PRINTING more money for infrastructure programs - this all causes the COST of GOODS to go up, and the value of money to go DOWN. Inflation is most easily defined by too many assets (money from people or the government) chasing TOO few goods. But guess who doesn't care if milk, a pair of jeans, or the cost of house goes up 7%. RICH PEOPLE don't care. Guess who does care - POOR PEOPLE!!! You know, those same people Biden and Democrats claim to care about. THEY are the ones who get hurt by these proposal.

✔ And spoiler alert - BEFORE you defend the Democrats because you feel like - "at least they are trying to tax the rich" - they AREN'T. Rich people take advantage of tax loopholes, and they SHOULD!!! If there is a legal way to avoid taxes, then it should be done. HOWEVER, if democrats TRULY wanted to tax the rich - a wealth tax would do that immediately. But they don't REALLY want to tax the rich - AKA their political allies and donors - So they say one thing, and do another. (***Spoiler alert, Republicans do the SAME SHIT when it comes to spending. They pretend to be fiscally conservative, then spend money like a drunken sailor once in office).

Back to the Biden tax plan...

✔ The Estate Tax limits are going to be cut in half. NOW, ARGUABLY, most individuals are NOT worth more than $6m - which is where the estate tax kicks in. So this doesn't affect a ton of people. HOWEVER, if we are just looking at the ethics and principles of an estate tax - it's CRAZY!!!! Think about this... you are taxed when you make the money (income tax), you are taxed when you spend the money (sales tax), you are taxed when you invest the money (capital gains tax / real-estate tax)... THEN, AFTER ALL THAT, if you end up with lots of money to leave your kids - you're taxed again??? What the ever-loving-fuck kind of sense does this make!!!

✔ The proposed new tax plan makes it harder to contributed to Roth IRAs, Solo 401Ks, and back-door mega 401Ks. Basically, all the ways that self-employed people used to be able to pay your taxes NOW, then grow your money tax free... ya, the government is trying to limit that as well.

✔ Increased the Net Investment Tax (NIT). Do you make your money from an S-corp, dividends & interest, trust income, property investment - Ya, you're going to pay more (somewhere around 3.8%) in additional taxes.

✔ Business owners who used to get to write off Qualified Business Interest Deductions (QBI) - ya, that's going away and/or phased out as well.

✔ 3% SURCHARGE on income over $5m. So, again, this doesn't affect a bunch of people - BUT, remember, these people MOSTLY live in states with high state income tax rates. So - 39% on Federal, 10% on state, 3% surcharge, with deductions going away - if you're a super high earner - you might be paying upwards of 55%-60% of your money towards taxes on each incremental dollar made - and then, if you spend this money - you get with sales tax, gas tax, cell phone tax, utility tax, property tax, etc., etc.,. HOW LONG before these people move their income and assets OFF shore to COMPLETELY avoid taxes- and the country gets ZERO. Ireland? Puerto Rico? Singapore? Switzerland? Mexico? Take your bets on where these people move.

✔ Did you inherit money from family in a trust, and make over $100,000 a year with your regular income - well, now your trust income is going to be taxed.

🛑 🛑 🛑 So... when is ENOUGH, ENOUGH??? How much money do we need to take in taxes, so that both parties can WASTE IT!!!

Federal deficits have increased 10-fold in the last 50 years. Does anyone really feel like we are getting 10x's the value from our government? Especially the Federal Government?

When the FUCK do we wake up and vote for people who are ACTUALLY responsible with the giant fiscal responsibility that has been bestowed upon them.

And P.S. - PLEASE don't be one of those people who wants to fight me on this... but ALSO writes off everything on YOUR taxes and don't pay your "fair share" either. I can't stand those people 🙂

And P.P.S - voting for, or supporting higher taxes, so you can feel good about the programs being funded by other people's money... that doesn't make you virtuous. It makes you greedy 🙂

Math ✅

Science ✅

English ✅

Money Management ❌

How can we create generational wealth when the basics aren't being taught?

Tag someone who needs to hear this 🎯

Find the full episode of our interview with Dr. BEA, EPISODE 190- On The Edge Podcast with Scott Groves. Listen and subscribe anywhere you listen to podcasts.

#FinancialLiteracy #GenerationalWealth #Education

400 people. One room. Less than 30 people of color. Something had to change 💫

Trust isn't just a word - it's the foundation of every breakthrough, every relationship, every step forward. Especially for Black men navigating today's world.

What's your experience with trust? Share below 👇

Find the full episode of our interview with Dr. B, EPISODE 188- On The Edge Podcast with Scott Groves. Listen and subscribe anywhere you listen to podcasts.

#BuildingTrust #BlackExcellence #CommunityFirst

Hint: It's not about the physical game anymore. The real competition? It's happening between the ears, 2 years before they ever step on that track.

Drop a 🧠 if you're ready to unlock your mental game

Find the full episode of our interview with Dr. BEA, EPISODE 190- On The Edge Podcast with Scott Groves. Listen and subscribe anywhere you listen to podcasts.

#MindsetFirst #OlympicMindset #ChampionshipDNA